Prelim

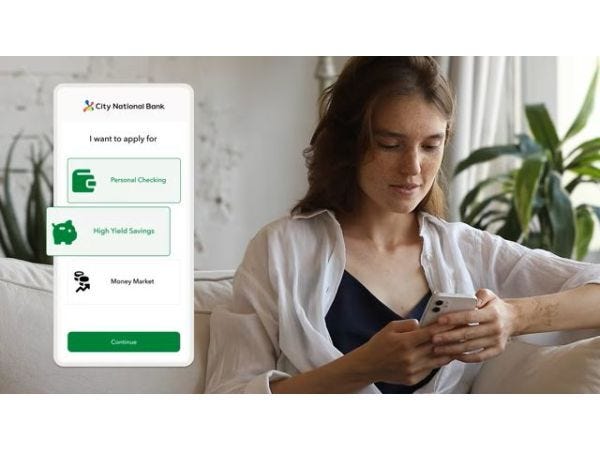

Fiserv partners with Prelim to introduce a no-code financial application solution available for commercial and consumer deposit account onboarding, both online and in-branch.

-

No-code builder

Launch new financial products and configure your workflow with an easy to use no-code editor.

-

Support Existing and New Customers

Retain new and existing customers by being able to board accounts. Retarget customers that drop off during the onboarding process to bring them back into the application.

-

Online and in-branch

Onboard new accounts anywhere, so you can scale growth and support existing physical branches.

-

Out-of-the-Box Fraud Prevention

Audit data points, standardize workflows, and manage risk during account boarding, all within one platform.

Prelim provides a no-code financial application solution for financial institutions to sell their products both online and in-branch, ensuring a seamless omni-channel customer experience for commercial and consumer account onboarding.

Starting with deposit and credit card originations, financial institutions can create first-class digital experiences for customers and employees.

- Version

- 2023.3